Commodity indexes experienced significant declines last week, mainly due to the sharp drop in oil prices. Additionally, the Fed’s hawkish statement denying a March interest rate cut contributed to downward pressure, pushing the dollar higher in the process..

Gold prices initially hit near record highs, but have since fallen on the back of strong U.S. employment data. Both Brent and WTI crude oil prices witnessed significant declines as US officials emphasized efforts to prevent further escalation of regional conflicts. The revision also reflects reduced concerns about widespread supply disruptions.

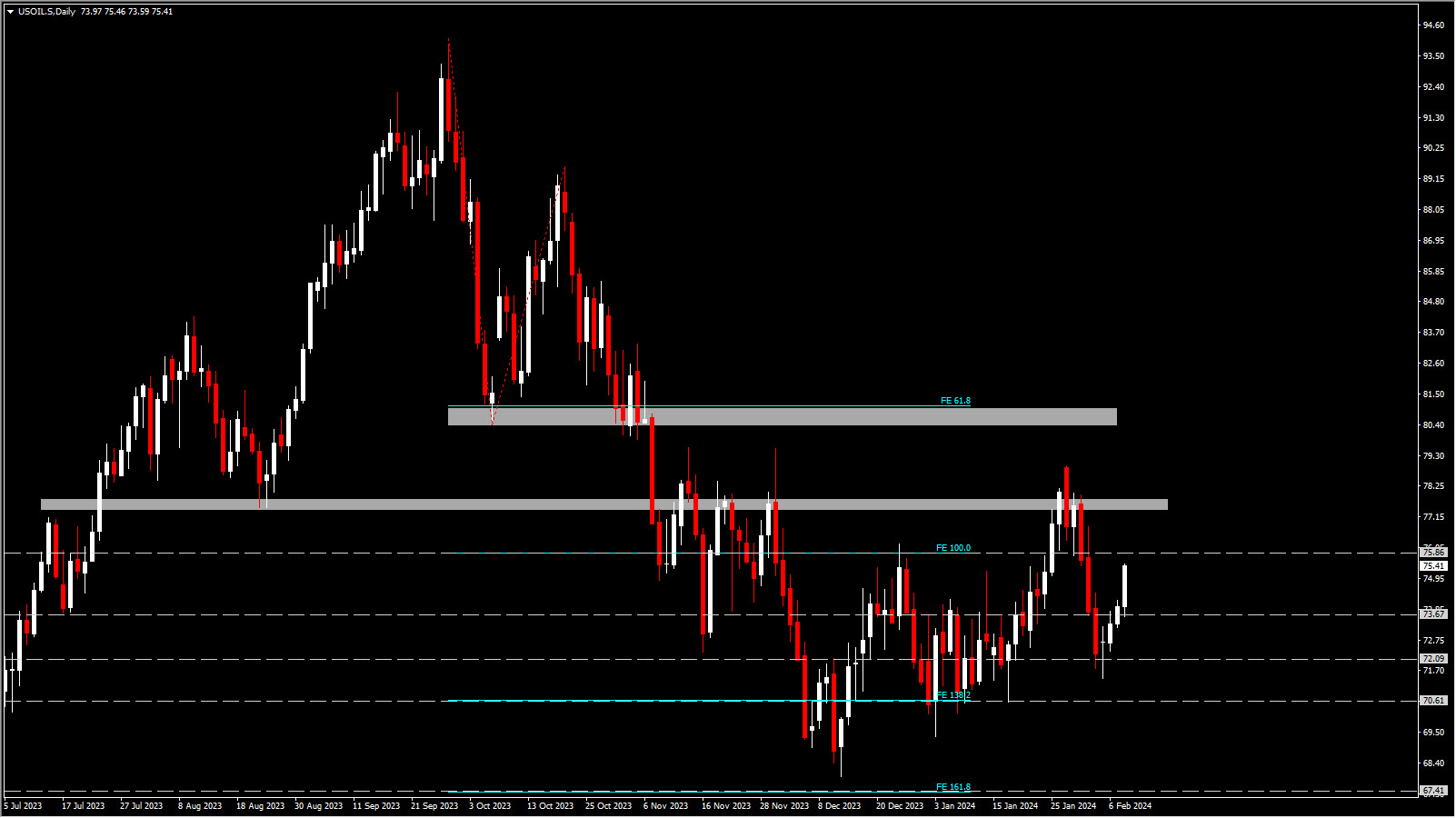

But this week, recent signs are that China’s growth slows down The Fed’s hawkish stance is Suppression of demand expectations. Crude oil prices continue to rise, and US oil Up more than 1% against the dollar75.30meanwhile Ukoil is trading at $80.60 per barrel. Prices rose for the first time in four sessions, but are still below levels seen before the Fed signaled last week that a March interest rate cut was unlikely.

Market attention remains Possible supply interruption and Global growth prospects As central bank policies and developments in the Middle East are evaluated. Israeli Prime Minister Benjamin Netanyahu has rejected a ceasefire offer from Hamas, but US Secretary of State Antony Blinken has signaled room for further negotiations.Moreover, official data revealed that larger than expected In the US, the decline was 3.15 million barrels. Last week’s gasoline inventory.

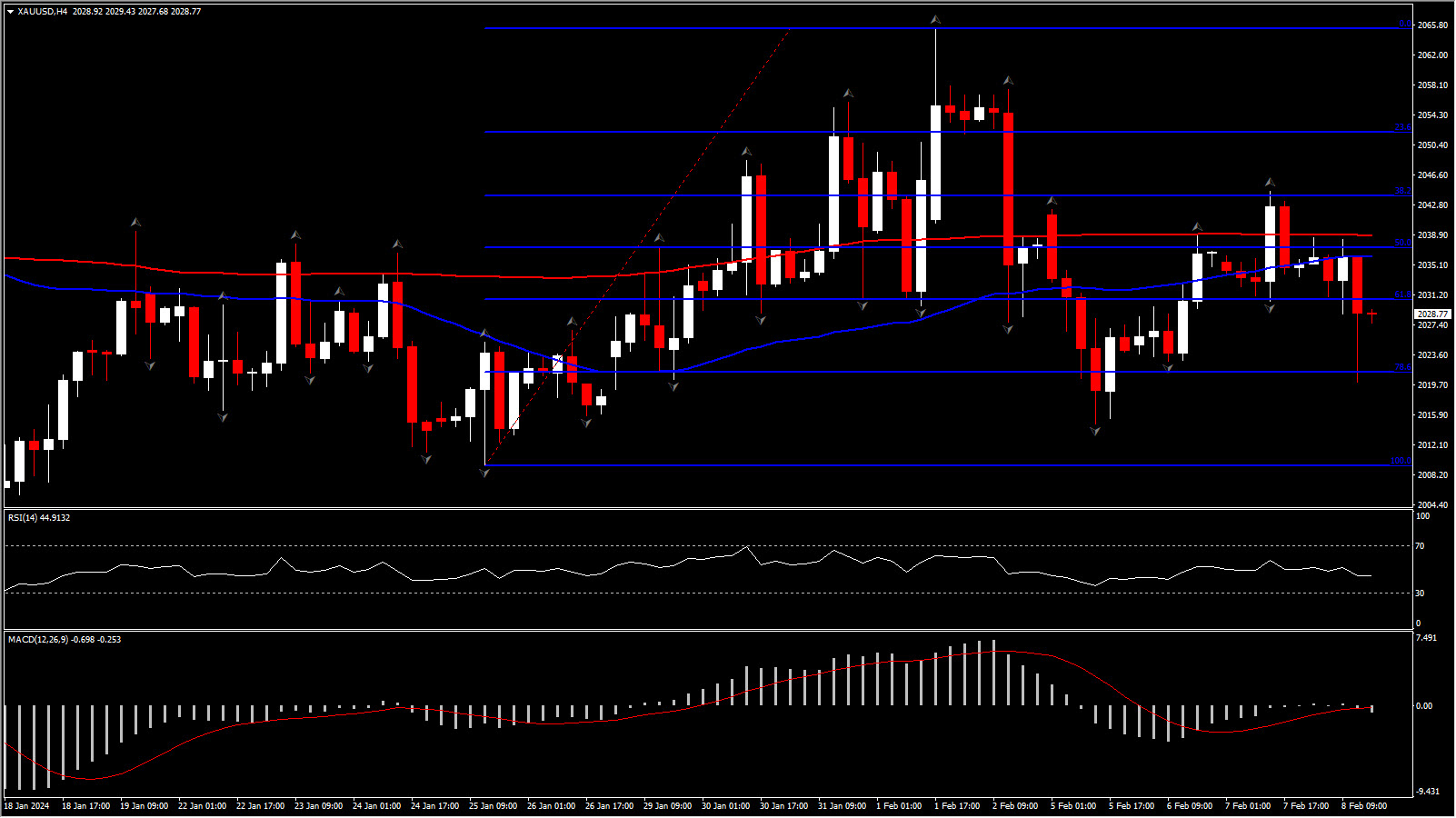

In the metal market, Money prices have reached their peak $2,065.48 per ounce before plummeting after better-than-expected results. US employment statistics and Mr. Powell’s subsequent comments. Amid geopolitical and economic uncertainty, overall demand for gold remained resilient. Latest report from the World Gold Council.

of Money Prices have retreated from last week’s highs but are still rising $2030 Waiting per ounce US CPI next week Further hints about the timing of a possible Fed rate cut this year. the current, Fed officials are hesitant to cut interest rates Until there is greater confidence that inflation will reach the 2% target. They cited a variety of reasons why they felt there was no rush to begin easing policy or to act quickly after easing. Therefore, higher interest rates increase the opportunity cost of holding gold.

meanwhile, palladium Prices have fallen to five-year lows as concerns about demand persist. Palladium fell 2%; $858 per ounce has reached an all-time low. August 2018.

copper Futures fell on concerns about Chinese demand, exacerbated by reports pointing to a continued decline in manufacturing activity. Meanwhile, deteriorating prospects for early interest rate cuts in the US and Europe are weighing on demand. Additionally, reports of the discovery of large copper deposits in Zambia contribute to long-term supply expectations.

Lithium prices remain depressed due to weak electric vehicle sales across China. Louise Street, senior market analyst at the World Gold Council, said despite short-term volatility, factors such as geopolitical tensions, trade uncertainty and ongoing elections around the world , investor interest in gold as a safe-haven asset is expected to remain throughout 2024.

click here To access the economic calendar

Andria Piscidi

market analyst

Disclaimer: This material is provided as a general marketing communication for informational purposes only and does not constitute independent investment research. This communication does not contain, or should be deemed to contain, investment advice, investment recommendations, or any solicitation for the purpose of buying or selling any financial instrument. All information provided has been collected from sources believed to be reliable and any information, including information indicating past performance, is not a guarantee or a reliable indicator of future performance. User acknowledges that investing in leveraged products involves a degree of uncertainty and that this type of investment involves a high level of risk, which is the sole responsibility of User. The Company is not responsible for any losses arising from investments made based on the information provided in this communication. This communication may not be reproduced or further distributed without our prior written permission.