Since most of my lecture notes have been migrated behind the gate (a software called Canvas used on many campuses), I thought I’d share some material that some Econbrowser readers might be interested in. I did.

First, the demand-supply gap against economic recession (Econ 442 Lecture 9):

Figure 1: Real GDP quarterly growth (blue) and year-on-year growth (tan), both calculated as log differences. NBER-defined recession peak-to-trough dates are shown in gray. Source: BEA, NBER, and author calculations.

Note that despite two consecutive quarters of negative GDP growth, there will be no NBER-defined recession in the first half of 2022. In contrast, in 2001 there was a recession defined as NBER, even though in recent GDP he did not have two consecutive quarters of negative growth (see here please refer to). Hamilton’s Markov switching model of recession did not indicate a recession at the time, and neither did the real-time therm rule.

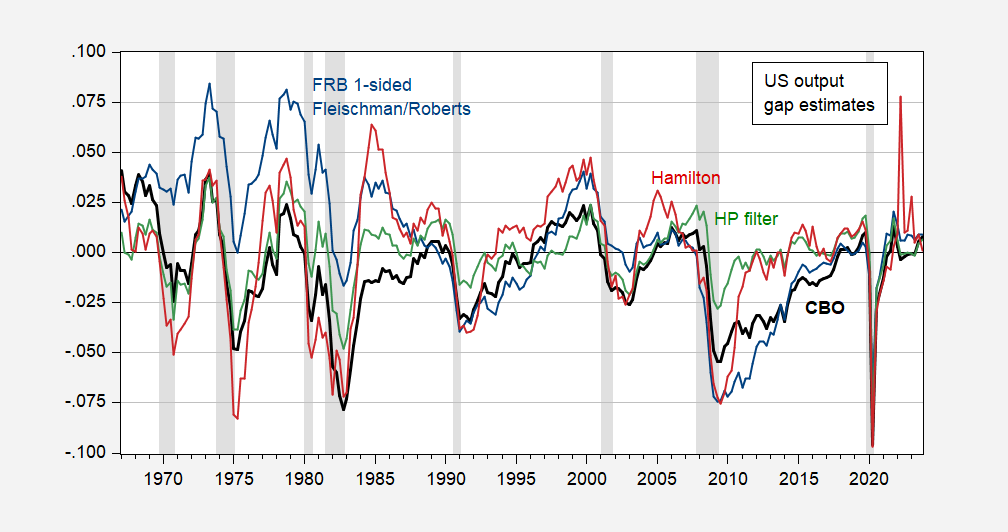

I refer to the following graph to distinguish between an output gap and a recession.

Figure 2: GDP gap, CBO (bold black), Fleischman/Roberts FRB (blue), from HP filter estimated from 1947 to 2023 (green), and from Hamilton filter estimated from 1967 to 2023 (red) . NBER-defined recession peak-to-trough dates are shown in gray.Source: BEA, CBO, February 2024 Atlanta Fed Taylor Rule Utility February 2024NBER, and authors’ calculations.

In the case of the euro area, BCDC of CEPR Although he pointed out that GDP in 2023 will be negative for two consecutive quarters, he has not declared a recession considering the increase in employment and working hours.

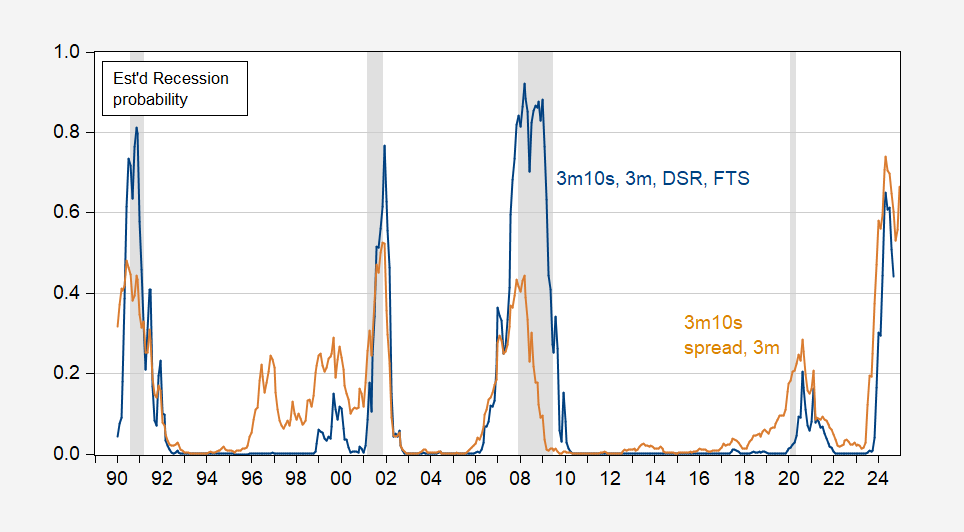

What about recession predictions? This is explained in this handout (Recession early warning system). Given the continued inversion of yields, it is not surprising that the probability of a recession is estimated to be high. On the other hand, in my research, Ferrara, ahmed, Kukko and chatelet and Stara Bourdillon Suggests other predictors. These provide alternative estimates of recession probabilities. Below, we examine the effects of foreign term spread and debt service ratio.

Figure 3: Probability of recession due to term spread and short-term interest rate (yellow) and term spread and short-term interest rate, public debt service ratio, and foreign term spread (blue). NBER-defined recession peak-to-trough dates are shown in gray. Source: NBER, and author calculations.

As I noted, handout:

…The estimated recession probability for February 2024 is 56% for the spread and short rate and 29.5% for the full spec. This means that just because there are no clear signs of a recession starting in January, it does not necessarily mean that a recession has been avoided. May 2024 is the best chance.

So be on the lookout for signs of an economic downturn.

As a side note, this is an example of how research can impact education.