Momentum trading strategy is a viable trading strategy used by many experienced traders. Prices typically continue to rise after wild price movements because momentum is strong. This provides a trading opportunity that many momentum traders take advantage of. This strategy shows how to trade with momentum that is consistent with the direction of the trend.

Adaptive ATR Keltner Channel

The Adaptive ATR Keltner Channel is a technical indicator based on the Keltner Channel indicator, first introduced by Chester Keltner in the 1960s. It is a trend-following technical indicator that follows price fluctuations and draws a band or channel-like structure.

Keltner channels are very similar to the widely used Bollinger Bands. The difference is that Bollinger bands use the standard deviation to measure the distance from the center line to the outer lines, whereas Keltner channels use multiples of the average true range (ATR) to measure the distance from the center line to the outer lines. is to measure the distance. .

There are two commonly used variations of the Keltner channel. One variation uses a simple moving average (SMA) to determine the midline, and the other uses an exponential moving average (EMA) to draw the midline. However, this variation of the Keltner channel uses an adaptive simple moving average to calculate the median line. This incorporates the use of efficiency ratios that Perry Kaufman used in the development of the Kaufman Adaptive Moving Average (KAMA).

This version of the Keltner channel is preset to use the standard price to calculate the midline instead of the normal closing price. This is represented by a solid light purplish-red line. The outer lines are drawn as dark gray dashed lines. The outer line distance is preset to 1x ATR from the center line. However, these presets can be changed within the indicator settings.

Since the central line is a moving average, traders can use this indicator as a trend direction indicator. This is based on the general location of price movements around the center line and the slope of the line.

It can also be effectively used as a momentum indicator. Traders may observe strong momentum candlesticks closing outside the channel after rebounding from the area near the center line.

great oscillator

The Awesome Oscillator (AO) is a technical indicator used to objectively measure and assess the direction of market momentum. This is typically done using a pair of Simple Moving Average (SMA) lines, which are preset as a 5-bar SMA and a 34-bar SMA. This indicator calculates the difference between 5 SMA and 34 SMA values and uses the resulting values to plot histogram bars and create an oscillator.

The direction of trend and momentum is indicated by whether the bars are overall positive or negative. On the other hand, the strength of the trend is indicated by an increase or decrease in the value of the bar. This version of his Awesome Oscillator conveniently plots green bars to indicate an increase in bar value and red bars to indicate a decrease in bar value. A positive green bar indicates the strength of the bullish trend direction, and a red positive bar indicates the direction of a weakening bullish trend. Conversely, negative red bars indicate a bearish trend direction and negative green bars indicate a weak bearish trend direction.

Traders often use bar values to identify trend direction and filter trades based on trend direction. Some traders also use the changing color of the bars to confirm trade entries in the direction of the trend. As an oscillator, AO can also be used to identify divergences, which are a sign of a trend reversal with high probability.

Trading strategy concept

This trading strategy is a trend continuation strategy that trades on momentum signals based on the confluence of the Awesome Oscillator and the Adaptive ATR Keltner Channel indicator.

The Awesome Oscillator is primarily used to identify the direction of a trend. This is based on whether the AO typically plots positive or negative bars. Traders should only isolate trades in the direction of the trend indicated by the AO.

After identifying the trend direction, traders can use the Adaptive ATR Keltner Channel Indicator to identify shallow pullbacks toward the center line. The price movement should then bounce off the center line and form a momentum candle that closes outside the adaptive ATR Keltner channel. Traders can use this momentum signal as an entry signal for trades.

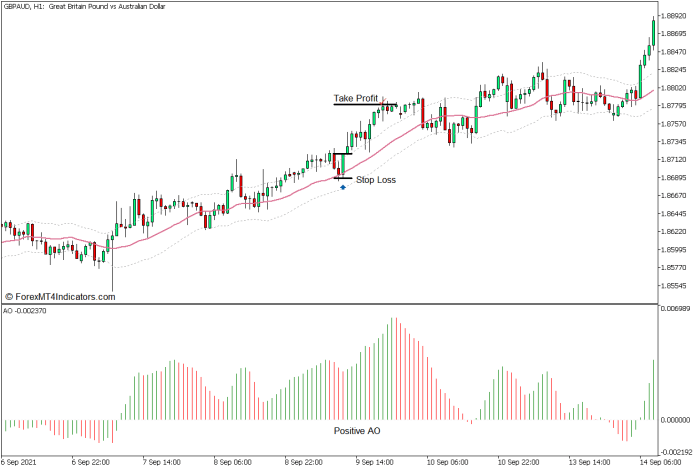

Purchase transaction settings

entry

- Generally, the Awesome Oscillator bar should be a plus.

- Price action should pull back towards the midline of the Adaptive ATR Keltner Channel indicator.

- Place a buy order as soon as the price action shows signs of price rejection in the midline area and the bullish momentum candlestick closes above the upper line of the adaptive ATR Keltner channel.

stop loss

- Set your stop loss below the bullish momentum candle.

Exit

- Set your take profit target to twice the size of your stop loss (in pips) and allow the price to reach your target.

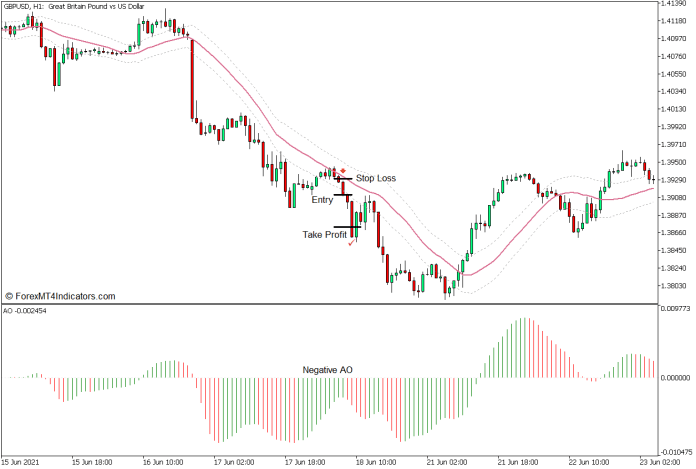

Setting up a sell trade

entry

- The Awesome Oscillator bar is usually negative.

- Price action should pull back towards the midline of the Adaptive ATR Keltner Channel indicator.

- Place a sell order as soon as the price action shows signs of price rejection in the midline area and the bearish momentum candlestick closes below the lower bound of the adaptive ATR Keltner channel.

stop loss

- Set your stop loss above the bearish momentum candlestick.

Exit

- Set your take profit target to twice the size of your stop loss (in pips) and allow the price to reach your target.

conclusion

This trading strategy is a viable momentum trading strategy that traders can use. This allows traders to objectively filter out unfeasible trades based on the set of rules used. However, there are situations in which the subsequent price movements are not strong enough to reach the target. There are some situations where trading opportunities form at the end of a trend, but traders should avoid this. Traders must still use sound judgment when deciding whether to place a valid trade.

Forex trading strategy installation instructions

This MT5 strategy is a combination of Metatrader 5 (MT5) indicators and templates.

The essence of this Forex strategy is to transform accumulated historical data and trading signals.

This MT5 strategy provides an opportunity to detect various characteristics and patterns in price movements that are invisible to the naked eye.

Based on this information, traders can anticipate further price movements and adjust this strategy accordingly.

Recommended Forex MetaTrader 5 trading platform

XM Market

- Free $50 To start trading right away! (Withdrawable profits)

- up to deposit bonus $5,000

- Unlimited loyalty program

- award winning forex broker

- Additional exclusive bonuses throughout the year

>> Claim your $50 bonus here <

How can I install this MT5 strategy?

- Please download the zip file below

- Copy the *mq5 and ex5 files to the Metatrader directory / experts / indicators /.

- Copy the tpl file (template) to the Metatrader directory / templates /.

- Start or restart your Metatrader client

- Choose a chart and timeframe to test your forex strategy

- Right-click on the trading chart and hover over “Templates”.

- Move to the right and select MT5 Strategy

- You can see that the strategy settings are available on the chart.

*Note: Not all forex strategies come with mq5/ex5 files. Some templates are already integrated with his MT5 indicator on the MetaTrader platform.

Click here to download:

Get download access